Car Excise Duty Malaysia

According to Malaysian Automotive Association MAA the excise duty imposed on cars ranges from 65 to 105. Prices for CKD locally assembled cars will increase by between 8-20 if new excise duty regulations are put in place due to a change in methodology of.

Topgear Ev Talk Why The New Tesla Model S S Road Tax Would Cost Rm17k In Malaysia

Excise Duties Sales Tax All 30 0 NIL 0 NIL 10 Notes.

. The first reason is Proton. Originally new excise duty regulations set by the customs department wouldve increased prices of CKD cars next year but this is no longer the case. The MAA anticipates a 2.

Excise Duties Exemption From Licencing Order 2019. The prices of locally assembled CKD cars will not increase come 2021. 1 Sept 2018 MALAYSIA.

This is because the waiver of excise duty which was deferred from 2020 until the end of 2022 will be resuming in 2023. Heres a bit of good news to end the year. CKD Car Prices Set To Go Up By 20 In 2023.

Cigarettes tobacco and tobacco products. MFN Most Favoured Nation rate ATIGA ASEAN Trade in Goods Agreement Updated. In Malaysia no import duty is imposed for cars originating from Asean countries while 30 import duty is imposed on vehicles imported from non-Asean countries.

Updated sales tax excise duties and customs orders. The Ministry of Finance issued the following updated Sales Tax Excise Duties and Customs Amendment Orders all with an effective date of 1 June 2022. Excise Duties Order 2022.

Excise Duties Order 2012. Meanwhile the import duty can go up to 30 which varies based on the vehicles. OTHER MOTOR CARS MALAYSIA.

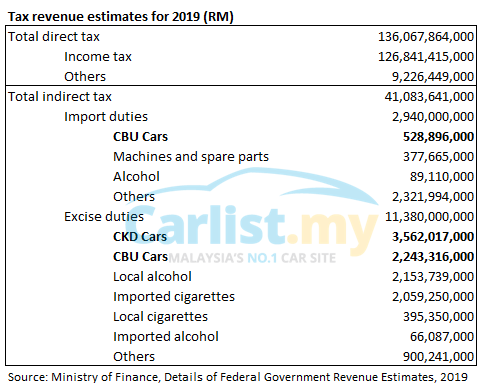

Excise duties collection in 2020 is expected to increase 49 to RM 11 billion due to higher demand for motor vehicles. What goods are subject to excise duty. DUTIES TAXES ON MOTOR VEHICLES A PASSENGER CARS INCLUDING STATION WAGONS SPORTS CARS AND RACING CARS CBU CKD CBU CKD IMPORT DUTY.

We MAA have already submitted a proposal to the Finance Ministry MoF to revert to the previous policy which did not include non-manufacturing-related costs in calculating the OMV thus lowering the car prices she said to reporters after chairing. A type of tax imposed on certain goods imported into or manufactured in Malaysia. At present the excise duty is set at between 60 to 105 for both locally assembled and imported cars and it is calculated based on the car model and engine capacity.

12102019 23630 PM. Car prices are further escalated by the tax rate and excise duty imposed. This was confirmed by the President of Malaysian Automotive Association MAA.

DUTIES TAXES ON MOTOR VEHICLES A PASSENGER CARS INCLUDING STATION WAGONS SPORTS CARS AND RACING CARS CBU CKD CBU CKD IMPORT DUTY IMPORT DUTY LOCAL TAXES CBU. Excise Duties Sweetened Beverages Payment Order 2019. Excise duties ranged between 75 percent to 105 percent and are calculated depending on engine capacity.

The implementation of the excise duty was postponed in 2020 to end-2022 and will be enforced starting next year. The New Straits Times reports that prices of Malaysias national cars may rise considerably once the government cuts import duties for imported cars and moves to impose excise duty on all vehicles. Excise Duties Sales Tax All 30 0 NIL 0 NIL 10 Notes.

The price of locally-assembled CKD cars is expected to increase by 8 to 20 in 2023 based on the new open market value OMV calculation of excise duty. The aim of this petition to make a request from our new government to abolish excise duties on cars. On top of sales tax depending on the car and its engine capacity excise duty is levied between 60 and 105.

What is the excise duty. Now that Malaysia is in a recovery period from the 3-month standstill during the Movement Control Order MCO Barjoyai said that it would be a good chance for the government to test the. Here is a quick look at the motor vehicle import and.

Car prices in Malaysia are generally expensive because of two reasons. Fortunately vehicles from ASEAN countries are not imposed with import duty. The moment Proton was created the old government decided to introduce a tax which.

Excise Duties Order 2017. Before the invention of Proton car prices were considerably cheaper in Malaysia before 1983. KUALA LUMPUR Dec 31 Reuters - Malaysia cut import duties on cars on Wednesday a year ahead of schedule but imposed excise duties of 60-100 percent to help offset the revenue fall.

On the other hand import duty can reach up to 30 depending on the vehicles country of manufacture. Cars imported from countries or are subjected to 30 percent import duty. Aside from the sales tax vehicles sold are also charged with other taxes namely excise duty and import duty.

So important are cars to the Malaysian Treasury that in the Ministry of Finances MoF Fiscal Outlook and Federal Government Revenue Estimates 2020 document the Ministry actually said. New Malaysia excise duty regulations introduced for 2020 could see CKD car prices rise by up to 15 Posted on January 20 2020 20012020 Last December a news report indicated the possibility that locally-assembled cars could cost more from this year as a result of a potential restructuring of automobile duty rates by the government.

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It 汽车专题 Carlist My

How Do You To Renew Your Insurance And Road Tax Online Wapcar

Why Is The Mazda 3 So Much More Expensive Than A Honda Civic Toyota Corolla Altis Wapcar

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It 汽车专题 Carlist My

Comments

Post a Comment